If you’ve noticed your homeowners insurance getting more expensive—or worse, receiving a non-renewal notice—you’re not alone. Across North Idaho, more homeowners are running into coverage issues than ever before. Even people with clean claims histories and well-maintained homes are being surprised by higher premiums, stricter underwriting, or carriers pulling out altogether.

So what’s going on?

1. Wildfire Risk Has Changed the Game

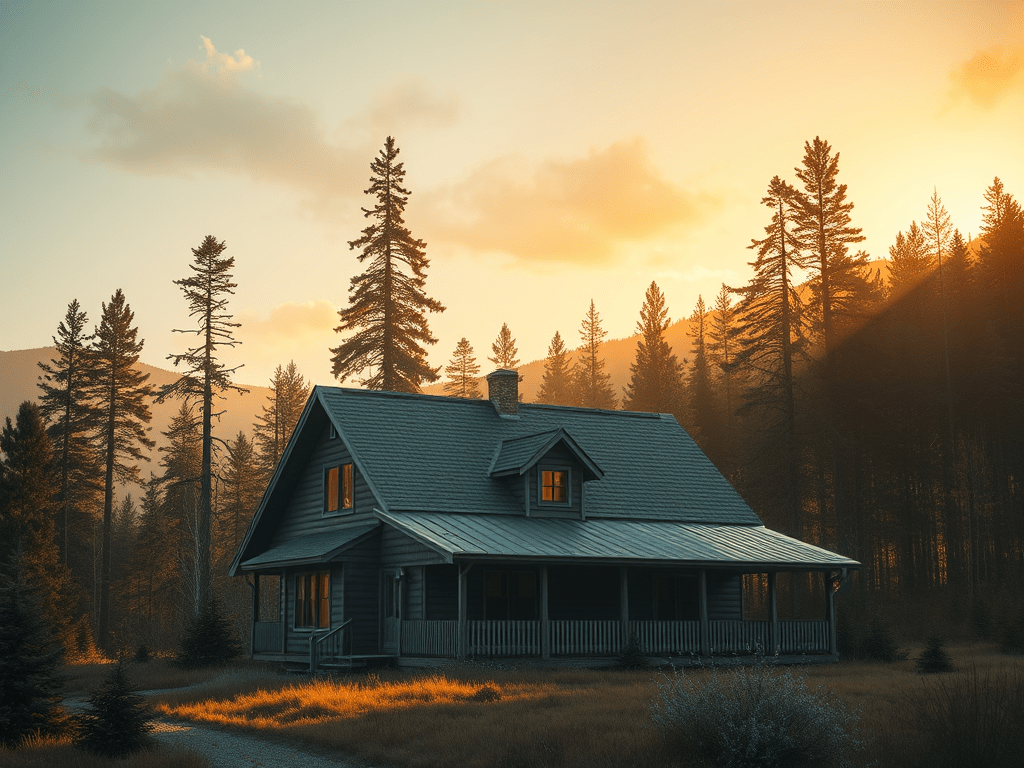

Wildfire exposure is the single biggest driver behind recent insurance changes in North Idaho. Carriers now rely on advanced risk models that evaluate brush density, slope, road access, and proximity to fire protection. Homes that were considered low risk ten years ago may now score poorly due to updated mapping and climate data.

This is especially true for rural properties, homes on acreage, or properties near timberland. Even if a wildfire has never occurred near your home, insurers are pricing based on potential, not history.

2. Distance to Fire Protection Matters More Than Ever

Many homeowners don’t realize how much distance to a fire station impacts insurability. In North Idaho, homes located more than five miles from a responding fire department—or those served by volunteer departments—often face limited carrier options or higher premiums.

Insurance companies also look at:

- Whether the fire department is staffed or volunteer

- ISO fire protection ratings

- Road access for emergency vehicles

- Location of the closest fire hydrant

None of this reflects how responsible you are as a homeowner—but it absolutely affects underwriting decisions.

3. Roof Age, Construction Type, and Property Features

Carriers have become far more selective about property characteristics, including:

- Older roofs (especially over 15–20 years)

- Wood shake or metal roofs nearing end of life

- Manufactured or mobile homes

- Wood stoves or secondary heat sources

These factors don’t mean your home is uninsurable—but they do reduce the number of carriers willing to offer coverage.

4. Why “Nothing Changed” Still Leads to Higher Rates

One of the most frustrating things homeowners hear is: “Nothing about your policy changed, but your rate went up.” Unfortunately, this is often true.

Insurance companies reprice entire regions based on:

- Loss trends across the state

- Reinsurance costs (what insurers pay to insure themselves)

- Inflation in labor and materials

- Increased severity of claims

So even responsible homeowners feel the impact.

5. Captive vs. Independent Agents: Why It Matters Now

If you’re working with a captive agent—someone who represents only one insurance company—you may be limited in options when that carrier tightens guidelines or exits a market.

Independent insurance agents work differently. Instead of being tied to a single company, they shop multiple carriers and underwriting programs to find solutions that fit your specific situation. In today’s insurance environment, that flexibility can make the difference between scrambling for coverage and having a stable long-term plan.

What You Can Do Right Now

If you’re concerned about your insurance, here are proactive steps that help:

- Review your roof age and maintenance records

- Ask about defensible space and brush mitigation

- Verify your home’s distance to fire protection

- Avoid last-minute shopping right before renewal

- Work with an agent who understands North Idaho underwriting realities

The earlier you address potential issues, the more options you’ll have.

Final Thoughts

Insurance in North Idaho isn’t broken—but it has changed. Homeowners who stay informed and work with local experts are far better positioned to protect their homes and budgets.

If you live in North Idaho and have questions about your homeowners insurance—especially if you’ve received a non-renewal or sharp increase—it’s worth having a conversation sooner rather than later.

Sometimes the best protection starts with understanding what insurers see when they look at your home.